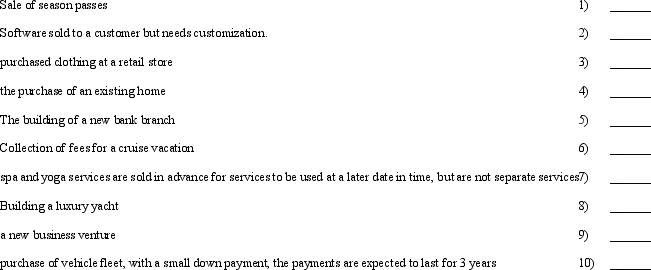

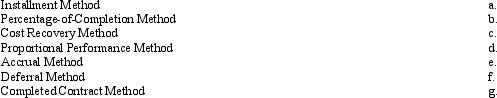

Revenue Recognition Methods:

Revenue Recognition Methods:  Required:

Required:

For each situation indicate what method of revenue recognition would be most appropriate.

Definitions:

Consumption Tax

Taxes applied on spending on goods and services, such as sales tax or Value Added Tax (VAT).

Income Tax

A tax levied by governments on individuals' or entities' income. The rate can vary based on income levels or earnings.

Average Tax Rate

The proportion of total income that is paid as tax, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Big Five

A model that outlines five broad dimensions of human personality traits: openness, conscientiousness, extraversion, agreeableness, and neuroticism.

Q20: In 2014, Cunningham Company determined that

Q31: The percentage-of-completion method of revenue recognition is

Q83: On January 1, 2014, Bedrock Company began

Q89: Under the straight-line amortization method, interest expense

Q98: Refer to Exhibit 15-7. The compensation expense

Q102: As of December 31, 2014, the Williamsburg

Q103: The interest rate used by the creditor

Q111: Significant influence of another company generally occurs

Q115: A lessor enters into a sales-type lease.

Q140: If a company sells its bonds at