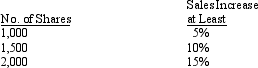

On January 1, 2015, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2019.

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2019.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan (2015 through 2019).

Definitions:

Funds

Financial resources set aside for a specific purpose, often pooled together from multiple sources and managed to achieve a specific investment goal.

Collecting

The action or hobby of gathering items of a particular type, often of cultural, historical, or financial value.

Transferred Check

A check that has been signed over by the original recipient to a new recipient, allowing the latter to cash or deposit the check.

Intermediary

An entity that acts as the middleman between two parties in a transaction, helping to facilitate communication and the exchange of goods, services, or information.

Q6: If material, the gross profit from installment

Q13: During 2014, Penny Co. had net income

Q18: Which of the following statements regarding intangible

Q40: On January 2, 2014, Mark Company acquired,

Q59: Under IFRS valuation allowances for deferred tax

Q100: Rising Sun, Inc. repossessed an item in

Q103: David, Inc. used the equity method of

Q105: What is a derivative financial instrument, provide

Q111: Significant influence of another company generally occurs

Q113: A company may want to increase its