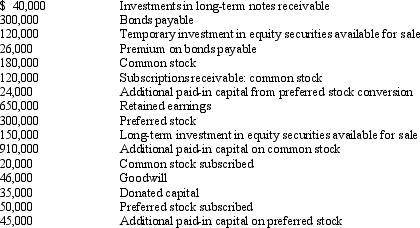

A partial listing of accounts and ending balances for Carver, Inc., on December 31, 2014, is shown below:

Following is additional information relative to the above accounts: Following is additional information relative to the above accounts:

•The preferred stock is 8% cumulative with par value of $50. For the preferred stock, 10,000 shares have been authorized, 6,000 shares are issued and outstanding, and 1,000 shares have been subscribed at a price of $65 per share. Each share of preferred stock is convertible into four shares of common.

•Bonds payable mature on September 30, 2018. They have a stated interest rate of 10%, payable semiannually. The straight-line method is used to amortize the premium.

•Common stock has a par value of $4 per share. For the common stock, 60,000 shares have been authorized, 45,000 shares are issued and outstanding, and 5,000 shares have been subscribed at $32 per share.

Required:

Prepare the contributed capital section of the December 31, 2014 balance sheet for Carver, Inc. Include appropriate parenthetical notes for the common and preferred stock.

Definitions:

Open Innovation Platforms

Online or digital environments that facilitate collaboration among individuals and organizations to share ideas, develop new products, or improve services.

Innovation Management Software

Software tools designed to help organizations manage their processes for innovation, from idea generation to product development and market introduction.

Market-Creating Innovation

Innovations that generate new markets, transforming existing markets by fulfilling unmet needs or introducing novel solutions.

On-Site Power Supply

Systems designed to generate power at the same location as its primary use, typically to ensure reliability and reduce transmission losses.

Q1: Under GAAP, the franchisor recognizes the initial

Q17: Define the following terms:<br>Treasury Stock<br>Authorized capital stock<br>Subscribed

Q28: On January 1, 2014, Jackson Hole Company

Q36: The Ripkin Corporation was organized and began

Q43: When is gross profit recognized under the

Q53: Which of the following is not a

Q70: Melissa Company, which was organized in January

Q70: Refer to Exhibit 13-03. What amount should

Q83: On January 1, 2014, Bedrock Company began

Q106: ......