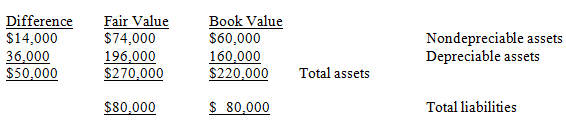

On January 1, 2014, the Z Corporation acquired a 20% interest in D Company by purchasing 4,800 shares of its 24,000 outstanding shares of common stock. The acquisition price was $30 per share. On the date of purchase, D Company's net assets were as follows:  During 2014, D Company earned income of $70,000 and paid dividends of $18,000. The depreciable assets have a ten-year remaining life and no residual value.

During 2014, D Company earned income of $70,000 and paid dividends of $18,000. The depreciable assets have a ten-year remaining life and no residual value.

Required:

Prepare all of the journal entries on Z Corporation's books to record the acquisition and subsequent events in 2014 related to the investment in D Company.

Definitions:

Q3: Which of the following groups would be

Q12: Several expenditures are listed below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6205/.jpg"

Q12: What is the IUPAC of the following

Q24: When an available-for-sale security is sold any

Q39: Which of the following methods of accounting

Q55: Peanut Company purchased a machine on January

Q70: What is the basic earnings per share

Q103: David, Inc. used the equity method of

Q107: If a company sells its bonds at

Q143: In 2013, the Hermes Corporation failed to