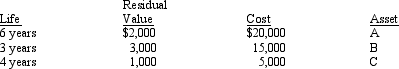

On January 1, 2014, Mullhausen Co. began using the composite depreciation method. There were three machines to consider, as follows:

At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

Definitions:

Android App

A software application developed for use on Android operating systems on smartphones and tablets.

Database Software

A type of computer program designed to manage, query, and manipulate databases.

Apache OpenOffice

A free and open-source office suite that includes word processing, spreadsheets, presentations, graphics, databases, and more.

G Suite

A collection of cloud-based productivity and collaboration tools developed by Google, including Gmail, Docs, Drive, and Calendar.

Q26: Pope has life insurance policies on its

Q29: List four transactions that comprise a corporation's

Q38: The mission of the Securities and Exchange

Q48: In 2015, Hart Co. invested $5,500,000 in

Q58: Roberts Corporation purchased some equipment by issuing

Q89: During 2013, Debbie Company incurred $240,000 in

Q105: The Lane Company incurred the following expenditures

Q116: On January 2, 2014, China Co. bought

Q119: On July 1, Sleepy, Inc. purchased 100

Q152: The proper procedure for computing the amortization