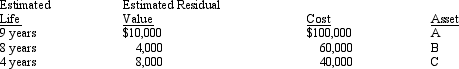

Information for heterogeneous assets A, B, and C of America Health and Fitness Club is provided below. The company uses composite depreciation for these assets.

Required:

a.Calculate the composite depreciation rate.

b.Journalize the sale of Asset C for $28,000 after two full years of use.

Definitions:

Carpet Manufacturer

A company that specializes in the design, production, and distribution of carpets and rugs for various applications.

Carpet Dealer

A business or individual specialized in selling carpets, often offering a range of designs, materials, and sizes.

Vertical Integration

The strategy of a company expanding its operations into different stages of production or distribution within the same industry, often to control the supply chain or reduce costs.

Joint Venture

A business arrangement where two or more parties agree to pool their resources for the purpose of accomplishing a specific task.

Q16: Which of the following structures has a

Q39: In 2013, Game Co. took advantage of

Q43: Refer to Exhibit 11-2. The accumulated depreciation

Q44: Trademarks or trade names<br>A) must be renewed

Q45: The Shane Company began business early in

Q48: Which one of the following statements is

Q60: Which one of the following statements is

Q66: Camp, Inc. exchanged a truck that cost

Q104: Recording property, plant, and equipment at historical

Q121: On January 1, 2015 Chase sold land