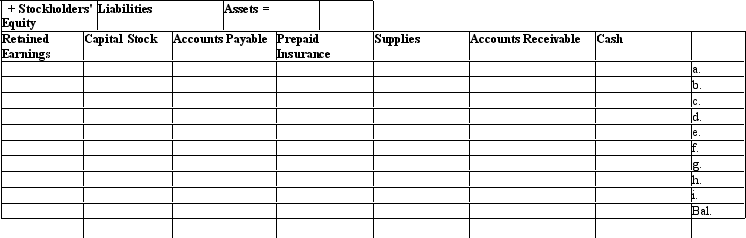

Assume the November transactions for Hoover Co. are as follows:

a. Received cash of from investors in exchange for capital stock.

b. Provided services of on accouni.

c. Purchased supplies on account .

d. Received cash of from clients for services previously billed.

e. Received for services provided from clients who paid cash.

f. Paid on account for supplies that had been purchased.

g. Paid for a one-year insurance policy.

h. Paid the following expenses: wages, ; utilities, ; rent, .

i. Paid dividends of to stockholders.

Record the transactions, using the integrated financial statement framework that follows:

Definitions:

Tax Effects

The impact of taxation on investment returns, business operations, or individual income.

Inventory Flow Assumptions

Accounting methods for determining the cost of inventory sold and remaining in stock, examples include FIFO (First In, First Out) and LIFO (Last In, First Out).

Cost Of Goods Sold

The direct costs associated with producing goods sold by a company, including materials and labor, affecting net income and profit margins.

Inventoriable Costs

Costs that are directly associated with the production of goods and are initially recorded as inventory, to be expensed as cost of goods sold when the goods are sold.

Q3: Receivables are usually a significant portion of:<br>A)

Q11: The accrual basis of accounting recognizes:<br>A) revenues

Q13: At the end of a period before

Q18: A pressurized spray painter was purchased on

Q37: For each of the following items

Q55: EFT:<br>A) means Efficient Funds Transfer.<br>B) can process

Q92: Current assets are assets that are expected

Q93: Adding a review of operations by an

Q96: The due date of a 90-day note

Q113: A disadvantage of static budgets is that