On July 1st, Harding Construction purchases a bulldozer for $330,000. The equipment has a 9 year life with a residual value of $15,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

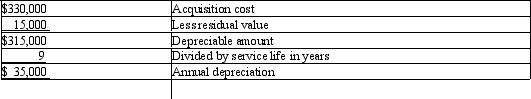

Annual depreciation is:

Definitions:

Fish

A member of a group of aquatic, gill-bearing animals that lack limbs with digits, typically moving through water by means of fins.

Concept

A concept embodying the essential traits of what it symbolizes.

Concrete

Referring to real, tangible objects or phenomena, as opposed to abstract concepts or ideas.

Genus

A category of biological classification that ranks above species and below family, used to group species that share common characteristics.

Q3: If direct materials cost per unit decreases,

Q4: A primary disadvantage of corporations is that

Q60: One of the two internal control procedures

Q101: What is the cost of the

Q113: A company will most likely use an

Q117: For the current year ending January 31,

Q135: The difference between the balance in Accounts

Q135: The following units of a particular item

Q136: Determine the amount to be added to

Q142: Unsold consigned merchandise should be included in