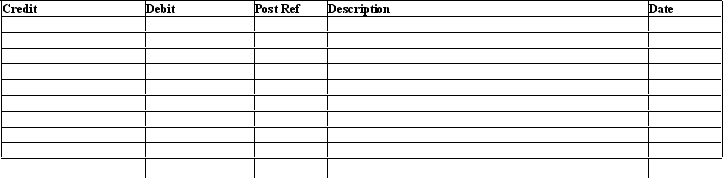

Journalize the following transactions for Solley Company that occurred during 2011 and 2012.

November 14, 2011 Received a $4,800.00, 90-day, 9% note from Alan Hibbetts in payment of his account.

December 31, 2011 Accrued interest on the Hibbetts note.

February 12, 2012 Received the amount due from Hibbetts on his note.

Definitions:

Deadweight Loss

The loss of economic efficiency that can occur when the free market equilibrium for a good or a service is not achieved.

Consumer Surplus

The contrast between the total price consumers aim and are capable of paying for a good or service and the price they actually pay.

Tax

Mandatory financial charges imposed by a government on individuals or entities to fund public expenditures.

Producer Surplus

The difference between the amount producers are willing to accept for a good or service and the actual amount they receive, due to higher market prices.

Q7: The maturity value of a note receivable

Q14: The units of Product Green-2 available for

Q33: Expenditures from a petty cash fund are

Q49: When a business borrows money, it incurs

Q51: Merchandise inventory at the end of the

Q70: Discuss the (1) focus and (2) financial

Q73: During 2012, Smith Corporation had an increase

Q77: The Anderson Company forecasts that total overhead

Q111: Under the direct write-off method of accounting

Q166: When a seller allows a buyer an