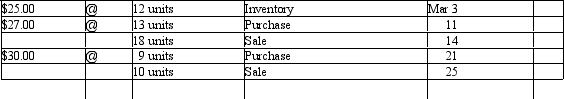

Beginning inventory, purchases and sales data for hammers are as follows:

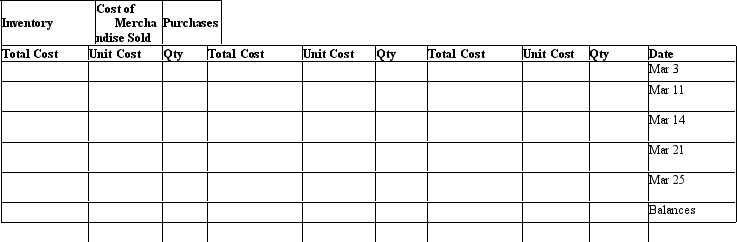

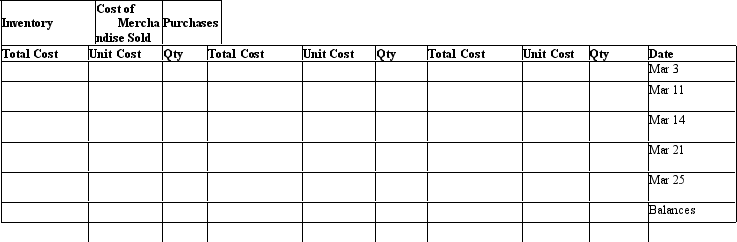

Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of merchandise sold and ending inventory under the following assumptions:

Assuming the business maintains a perpetual inventory system, complete the inventory cards and calculate the cost of merchandise sold and ending inventory under the following assumptions:

a. First-in, first-out

b. Last-in, first-out

b. Last-in, first-out

Definitions:

Plant Assets

Long-term tangible assets used in the operation of a business and not expected to be converted to cash in the short term.

Land Improvements

Expenses for enhancements made to a parcel of land to make it more usable, which do not directly include the land itself but, for example, landscaping, parking lots, and fences.

Depreciated

Refers to the reduction in value of an asset over time due to wear and tear or obsolescence.

Useful Life

The estimated period over which an asset is expected to be useful in the operations of a business before it is fully depreciated.

Q3: The primary difference between a periodic and

Q27: Which of the following accounts has a

Q42: Beginning inventory, purchases and sales data for

Q78: Other than accounts receivable and notes receivable,

Q96: Allowance for Doubtful Accounts has a credit

Q118: Depositing all cash, checks, etc. in a

Q140: Present entries to record the following transactions:<br>

Q147: Journalize the following petty cash transactions.<br>(a) On

Q164: Following the completion of the bank reconciliation,

Q211: The single-step income statement is easier to