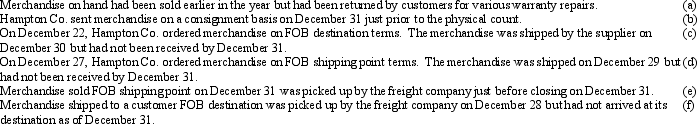

Hampton Co. took a physical count of its inventory on December 31. In addition, it had to decide whether or not the following items should be added to this count.

Indicate which items should be added to (answer: yes) and which items should not be added to (answer: no) the December 31 inventory count.

Indicate which items should be added to (answer: yes) and which items should not be added to (answer: no) the December 31 inventory count.

Definitions:

Mark-up

The amount added to the cost price of goods to cover overhead and profit; the difference between the selling price and the cost price.

Sale Price

The final amount at which an item or service is sold after any discounts or deductions.

Operating Profit

Earnings before interest and taxes (EBIT), reflecting the profit a company makes from its operations, before financial and other non-operational costs.

Reduced Price

A lower cost for goods or services, typically offered during sales, discounts, or promotions.

Q12: In recording the cost of merchandise sold

Q69: A $140 petty cash fund has cash

Q102: For each of the following notes receivables

Q108: Which of the following measures the relationship

Q121: Allowance for Doubtful Accounts has a debit

Q126: The following lots of a particular commodity

Q139: When the allowance method for accounting for

Q152: Accruals are needed when an unrecorded expense

Q163: Consider the cash account below.<br>Additional Information:

Q204: Under the periodic inventory system, the cost