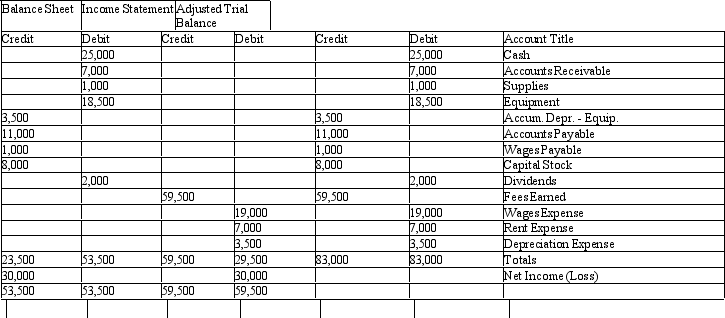

Marcus Enterprises began in 2011 when Damien Marcus invested $8,000 in exchange for capital stock. The following is the work sheet for the company at the end of the first year in business.

Marcus Enterprises

Work Sheet

For the Year Ended December 31, 2011

Prepare an income statement, retained earnings statement, and classified balance sheet for Marcus Enterprises for the year ended December 31, 2011.

Prepare an income statement, retained earnings statement, and classified balance sheet for Marcus Enterprises for the year ended December 31, 2011.

Definitions:

Foreign Country

A country that is different from one’s own, pertaining to any nation outside of one's national boundaries.

Core Components

Fundamental parts or elements that are essential for the functioning or existence of a system, process, or concept.

Self Competency

An individual's ability to understand and manage one's own abilities and actions effectively.

Immediate Environment

The physical and social surroundings that are directly accessible and interactable to an individual at any given time.

Q18: In accordance with the rules of debit

Q18: Which one of the following accounts below

Q41: On January 1, 2011, Cary Parsons established

Q49: All of the following statements regarding vertical

Q97: The dividends account is an example of

Q98: The income statement will include<br>A) revenues less

Q106: The following are steps in the accounting

Q126: Posting a part of a transaction to

Q166: Accrued taxes payable are generally reported on

Q174: The unearned revenues account is an example