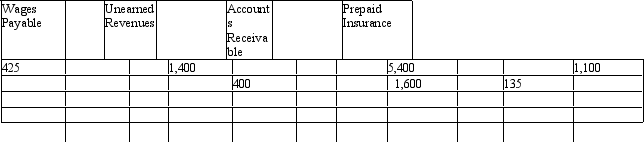

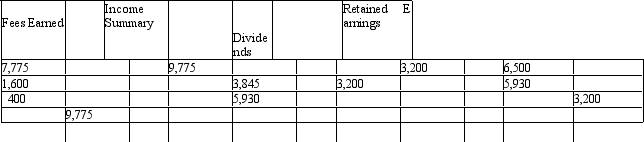

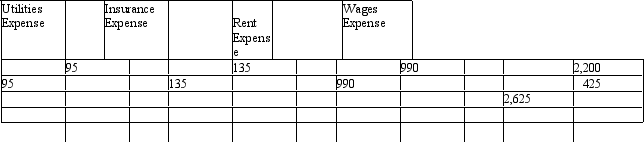

Prepare an income statement and a retained earnings statement for the month ended August 31, 2011, from the following T accounts of Marley Company.

Definitions:

CCA Class

Refers to the classification of fixed assets under the Canadian Capital Cost Allowance for the purpose of tax depreciation.

After-Tax Lease Payment

The lease payment amount after accounting for the tax benefits or obligations, impacting the net cost to the lessee.

Tax Rate

The share of income an individual or business entity is required to pay in taxes.

CCA Class

A classification used in Canadian tax law for determining the depreciation rate for different types of tangible capital assets.

Q20: Accumulated depreciation appears on the<br>A) balance sheet

Q27: The following units of an inventory item

Q29: The retained earnings statement begins with the

Q39: Bargain Wholesalers sells pet supplies to retailers,

Q67: If the two totals of a trial

Q106: When an accounts payable account is paid

Q111: The report on internal control required by

Q143: Which of the following is not considered

Q170: A company pays $6,500 for two season

Q211: The single-step income statement is easier to