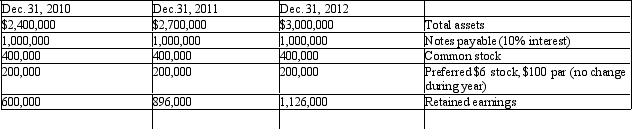

The following selected data were taken from the financial statements of the Berrol Group for December 31, 2012, 2011, and 2010:

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

Definitions:

Excise Tax

A form of taxation applied on certain goods, services, or activities, often included in the price of products like gasoline, alcohol, and tobacco.

Incidence

The measurement or frequency of occurrence, often used in the context of the distribution of a tax burden.

Federal Tax System

The mechanism by which the United States government collects taxes from individuals and businesses to fund public services and infrastructure.

Progressive

In economics, refers to taxation or policies that proportionally take more from those who have more income or wealth.

Q15: The following errors took place in journalizing

Q44: The Victor Corporation issues 1,000, 10-year, 8%,

Q46: Skyline, Inc. purchased a portfolio of available-for-sale

Q63: Which of the following is considered to

Q73: A $500,000 bond issue on which there

Q90: An analysis of the general ledger accounts

Q94: Sinclair Company's accumulated depreciation-equipment increased by $6,000,

Q123: One reason a dollar today is worth

Q153: <span class="ql-formula" data-value="\begin{array}{ll}530,000 & \text { Accounts

Q168: Prepare a journal entry on October 12