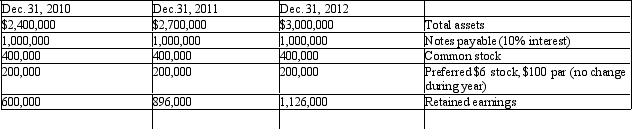

The following selected data were taken from the financial statements of the Berrol Group for December 31, 2012, 2011, and 2010:

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

The 2012 net income was $242,000 and the 2011 net income was $308,000. No dividends on common stock were declared between 2010 and 2012.

Required:

(1) Determine the rate earned on total assets, the rate earned on stockholders' equity, and the rate earned on common stockholders' equity for the years 2012 and 2011. Round to one decimal place.

(2) What conclusion can be drawn from these data as to the company's profitability?

Definitions:

Machinery

Machines and their parts that perform specific tasks or are used to manufacture products in an industrial setting, contributing to productivity in sectors such as manufacturing and agriculture.

Debt-to-Equity Ratio

A financial metric indicating the relative proportion of shareholders' equity and debt used to finance a company's assets.

Return on Equity

A measure of a corporation's profitability that reveals how much profit a company generates with the money shareholders have invested.

Return on Assets

A financial ratio that measures how efficiently a company uses its assets to generate net income, typically expressed as net income divided by total assets.

Q7: Which of the following can be found

Q10: If the accounts receivable turnover for the

Q33: The statement of cash flows is one

Q72: The unexpired insurance at the end of

Q106: At 12/31/2009, the cash and securities held

Q143: On the statement of cash flows, the

Q158: If land costing $145,000 was sold for

Q163: If the market rate of interest is

Q168: What type of analysis is indicated by

Q169: The company determines that the interest expense