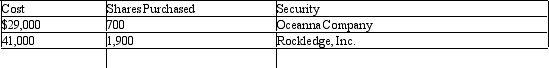

During 2012, its first year of operations, Makala Company purchased two available-for-sale investments as follows:

Assume that as of December 31, 2012, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share.

Assume that as of December 31, 2012, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share.

Makala had 10,000 shares of no par stock outstanding that was issued for $150,000. For the year ending December 31, 2012, Makala had a net income of $105,000. No dividends were paid.

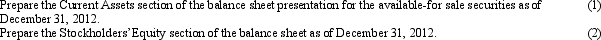

Required:

Definitions:

Adults Ages 55+

A demographic group consisting of individuals who are 55 years old and above.

TEDS-A Data

Information collected through the Treatment Episode Data Set - Admissions, focusing on the demographics and substance abuse characteristics of treatment admissions.

Commonly Reported Substance

A substance often cited in surveys or studies for its frequent use or misuse by individuals.

Adolescents

Individuals in the transitional stage of human development from childhood to adulthood, typically ranging from ages 13 to 19.

Q41: On September 1, 2012, Parsons Company purchased

Q45: Why would you or why wouldn't you

Q49: Answer the following questions for each of

Q69: Blanton Corporation purchased 12% of the outstanding

Q86: A company issued $2,000,000 of 30-year, 8%

Q109: Selling the bonds at a premium has

Q129: To determine cash payments for income tax

Q143: The main source of paid-in-capital is from

Q146: Based on the following data, what is

Q165: Journalize the following selected transactions for April