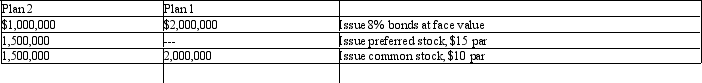

Ulmer Company is considering the following alternative financing plans:

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Required: Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Definitions:

Greater Autonomy

Having more independence or freedom to make one's own decisions without much external influence or control.

Co-Located Teams

Teams whose members work together in the same physical location, facilitating direct interaction and collaboration.

Private Information

Data or details that are personal or sensitive in nature and not meant to be shared with or accessible by the public.

Team Opportunity

A chance or prospect for a group to work together towards a common goal or project.

Q11: If a business issued bonds payable in

Q20: Which of the following is not a

Q24: On January 1, 2011, Gemstone Company obtained

Q45: Temporary investments are recorded at their cost

Q77: A bond is usually divided into a

Q115: On April 1, 2012, ValueTime, Inc. had

Q118: Although marketable securities may be retained for

Q137: Companies may report comprehensive income on each

Q154: Why would you compare or not compare

Q159: On the statement of cash flows, a