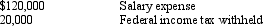

Excel Products Inc. pays its employees semimonthly. The summary of the payroll for December 31, 2012 indicated the following:

For the year ended 2012, $40,000 of the December 31 payroll is subject to social security tax of 6%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%. As of January 1, 2013 all of the $120,000 is subject to all payroll taxes. Present the journal entries for payroll tax expense if the employees are paid (a) December 31 of the current year, (b) January 2 of the following year.

For the year ended 2012, $40,000 of the December 31 payroll is subject to social security tax of 6%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%. As of January 1, 2013 all of the $120,000 is subject to all payroll taxes. Present the journal entries for payroll tax expense if the employees are paid (a) December 31 of the current year, (b) January 2 of the following year.

Definitions:

Transracial Adoption

The adoption of a child that is of a different race than the adoptive parents, aimed at providing a loving home to children while also navigating cultural and identity issues.

Vicarious Parenthood

Experiencing the roles and responsibilities of parenting indirectly, such as through caring for a relative's or friend's child.

Infertility

The inability to conceive a child after trying for a certain period, usually around a year.

Pelvic Inflammatory Disease

A serious infection of the female reproductive organs, often caused by sexually transmitted bacteria.

Q10: The following totals for the month of

Q11: Significant changes in stockholders' equity are reported

Q11: Which of the following is not one

Q47: A company has 10,000 shares of $10

Q72: A $300,000 bond was redeemed at 103

Q84: A corporation was organized on January 1

Q88: Goods purchased on account for future use

Q103: When common stock is issued in exchange

Q106: At 12/31/2009, the cash and securities held

Q109: The Austin Land Company sold land for