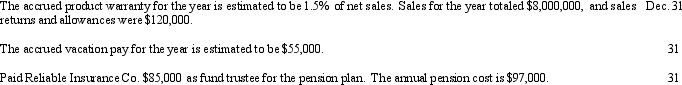

Journalize the following transactions:

Definitions:

Taxes Expense

The total amount of taxes owed by an individual or corporation to the government within a fiscal period.

Adjusted Entry

An accounting record made to amend the effects of previously recorded transactions to accurately reflect financial realities.

Taxes Expense

The total amount of taxes owed by a business to federal, state, and/or local governments as determined by applicable tax rates on business income.

Next Period

Refers to the upcoming or following time frame in financial and operational planning, often contextually determined.

Q44: Accounting terminology<br>Listed below are seven technical

Q60: Medicare taxes are paid by both the

Q68: The journal entry a company uses to

Q117: In setting standards, management's level of performance

Q118: Capital budgeting computations<br>A project costing $80,000

Q147: A business paid $7,000 to a creditor

Q148: Liabilities are reported on the<br>A) income statement<br>B)

Q158: Which of the following is not a

Q170: On January 5, 2012, Garrett Company, a

Q178: Indicate whether each of the following activities