Foreign Currency Transactions The Following Table Summarizes the Facts of Five Independent Cases

Foreign currency transactions

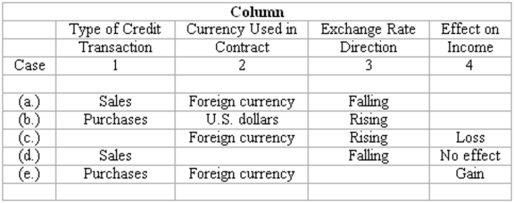

The following table summarizes the facts of five independent cases (labeled a through e) of American companies engaging in credit transactions with foreign corporations while the foreign exchange rate is fluctuating:

Instructions:

After evaluating the information about each case, fill the blank space that has been left in one of the four columns denoted by a yellow color.

The content of each column and the word or words that you should enter in the blank spaces are described below:

Column 1 indicates the type of credit transaction in which the American company engaged with the foreign corporations. The answer entered in this column should be either "Sales" or "Purchases."

Column 2 indicates the currency in which the invoice price is stated. The answer may be either "U.S. dollars" or "Foreign currency."

Column 3 indicates the direction in which the foreign currency exchange rate has moved between the date of the credit transaction and the date of settlement. The answer in this column may be either "Rising" or "Falling."

Column 4 indicates the effect of the exchange rate fluctuation upon the income of the American company. The answers entered in this column are to be selected from the following: "Gain," "Loss," or "No effect."

Definitions:

Per-unit Cost

The cost incurred for producing a single unit of a product, which is calculated by dividing the total cost of production by the total number of units produced.

Monopolistic Firm

A company that has exclusive control over a particular market or industry, limiting competition.

Government Regulation

Rules set by the government to control the way businesses can operate within an economy.

Production Costs

The expenses incurred during the process of creating a good or service, including labor, materials, and overhead costs.

Q13: Metalworks employs 3 assembly workers that, on

Q37: The following information is available from the

Q45: Pool-Glow, Inc. has developed a new light

Q76: The entry to record the sale of

Q101: Indicate which of the following statements are

Q117: Which of the following is an investing

Q135: Comprehensive income differs from net income in

Q152: The FASB classifies interest received on investments

Q157: Peak pricing charges:<br>A) A higher price when

Q162: Which of the following is not classified