Percentage changes

Selected information from the financial statements of Perfectly Baked Cake Co. appears below:

(a) Compute the percentage change in each of the above items from 2010 to 2011. Use a + or - to indicate increase or decrease.

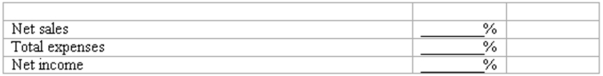

(b) Compute net income as a percentage of net sales in each year. (Round to the nearest one-tenth of 1%)

Definitions:

Metric System

A decimal system of measurement based on meters, liters, and grams as units of length, volume, and weight, respectively.

Incentive Spirometer

A medical device used to help patients improve the functioning of their lungs and to prevent pulmonary complications by encouraging deep breathing.

Abdominal Surgery

A surgical procedure involving the opening of the abdomen to diagnose, treat, or prevent disease in various abdominal organs.

Material Reinforcement

Strengthening a material by adding a second material to it, often used to increase the durability, strength, or resistance of the original material.

Q5: Utah Ranchers exports beef to Japan. In

Q40: When goods are sold, a journal entry

Q57: The cost of goods sold in April

Q77: On January 1, 2010, Alice Corporation had

Q79: The Schedule of Finished Goods Manufactured summarizes

Q90: What are the setup costs allocated to

Q125: All of the following are financing activities

Q141: The net assets of a corporation are

Q144: Preferred stockholders are owners of the corporation

Q154: It is illegal for the government to