Computation of cash flows

An analysis of changes in selected balance sheet accounts of Taurus Corporation shows the following for the current year:

The income statement for the current year included the following items relating to the transactions summarized above:

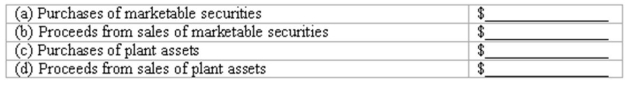

All payments and proceeds relating to these transactions were in cash. Using this information, compute the following cash flows for the current year:

Definitions:

Intermittent Reinforcement

A conditioning schedule where a response is sometimes reinforced, leading to more robust behavioral responses.

Variable Interval Schedule

A reinforcement schedule in which a response is rewarded after an unpredictable amount of time has passed.

Behavioral Techniques

Methods or strategies used to alter or influence behaviors, often through the application of learning principles.

Negative Reinforcement

A behavioral strategy involving the removal of a stimulus to increase a desired response.

Q13: A company has a "hedged position" when

Q26: The total amount of inventory that should

Q29: Foreign currency transactions<br>The following table summarizes the

Q34: Refer to the information above. How many

Q52: The cost of finished goods manufactured in

Q62: "Discontinued operations" is an example of an

Q90: The amount of cash paid by Hierarchy

Q113: What is the quick ratio?<br>A) 5%.<br>B) 1.5

Q114: Lewis Corporation issued 125,000 shares of $5

Q119: Refer to the information above. Total stockholders'