Computation of cash flows

An analysis of changes in selected balance sheet accounts of Gable Corporation shows the following for the current year:

The income statement for the current year included the following items relating to the transactions summarized above:

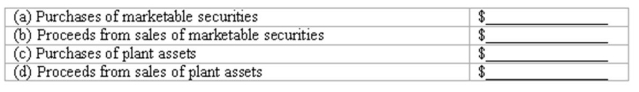

All payments and proceeds relating to these transactions were in cash. Using this information, compute the following cash flows for the current year:

Definitions:

Employees

Individuals who work for another person or company in exchange for compensation, under the direction and control of their employer.

NLRB

The National Labor Relations Board, a U.S. government agency responsible for enforcing U.S. labor laws in relation to collective bargaining and unfair labor practices.

Delay Tactics

Strategies or actions taken to slow down or postpone a process, often used in negotiations or legal contexts to gain an advantage or simply to buy time.

Employers

Individuals or entities that hire people to perform services or work in exchange for compensation.

Q5: Utah Ranchers exports beef to Japan. In

Q17: Which of the following businesses or individuals

Q18: The total amount of the current liability

Q34: If interest receivable was $6,300 at December

Q57: In the 2010 statement of cash flows

Q71: In a classified balance sheet, assets are

Q90: Each of the following must be disclosed

Q110: ROE - return on equity - is

Q122: A liquidating dividend:<br>A) Occurs only when a

Q125: The Piazza Company has working capital of