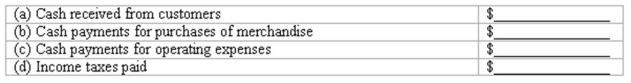

Computation of operating cash flows

The financial statements of Custom Corporation provide the following information for the current year:

Using this information, compute for the current year:

Definitions:

Accrual Basis Accounting

An accounting method where income and expenses are recorded when they are earned or incurred, regardless of when the cash is actually received or paid.

Cash Flow

The total amount of money being transferred into and out of a business, affecting the organization's liquidity.

Fund-Raising Results

The outcomes or achievements of efforts to collect financial resources or donations, often critical for the operation and projects of nonprofit organizations.

Program Results

The outcomes or impacts of a project or program, often used as a measure of its effectiveness.

Q5: At the end of the first year

Q9: The debt ratio is a measure of:<br>A)

Q10: How many shares of common stock are

Q30: In a single-step income statement, all revenue

Q110: Manufacturing overhead is best described as:<br>A) All

Q121: Refer to the information above. If Caesar

Q122: If a retail store has a current

Q129: Measures of solvency and credit risk<br>Shown below

Q129: Refer to the information above. What is

Q159: The more pessimistic investors' expectations regarding a