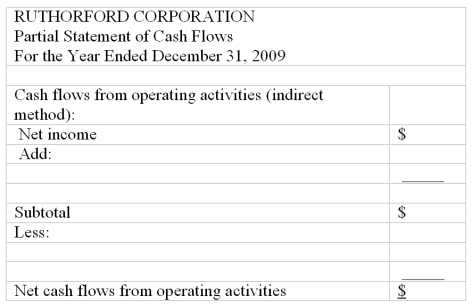

Cash flows from operating activities-indirect method

The data below are taken from the financial statements of the Rutherford Corporation:

Complete the partial statement of cash flows for the year ended December 31, 2009, showing the computation of net cash flows from operating activities by the indirect method:

Definitions:

Production Budget

An estimate of the total cost of production that includes direct labor, raw materials, and overhead expenses for a specific period.

Budgeted Unit Sales

The forecasted quantity of products that a company plans to sell over a specific period.

Beginning Finished Goods

The inventory of finished products available for sale at the start of an accounting period.

Ending Finished Goods

The value of goods available for sale at the end of an accounting period.

Q14: Sinking funds make a bond issue less

Q26: Shares that have been sold and are

Q31: The average issue price per share of

Q62: Which one of the following is not

Q85: When products held in inventory are sold:<br>A)

Q104: The directors of a corporation:<br>A) Are hired

Q119: The price at which a bond sells

Q125: A corporation must always have more than

Q175: The amortization of bond discount by the

Q199: Which of the following is not true