Computation of cash flows

An analysis of changes in selected balance sheet accounts of Gable Corporation shows the following for the current year:

The income statement for the current year included the following items relating to the transactions summarized above:

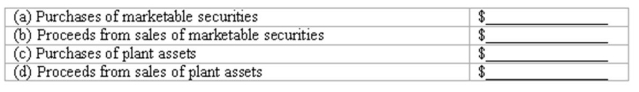

All payments and proceeds relating to these transactions were in cash. Using this information, compute the following cash flows for the current year:

Definitions:

Supreme Court

The supreme judicial authority in the United States, comprised of nine justices, and possesses overarching legal power over every other court in the country.

State Laws

Statutes and regulations that are established and enforced by individual U.S. states and apply within their specific territorial boundaries.

Federal Legislation

Laws passed by the national government of a country.

Unconstitutional Acts

Actions taken by governing bodies or officials that are in violation of the governing constitution's stipulations.

Q20: Blue Waters is an American company that

Q23: As foreign exchange rates fall, importers based

Q32: The purpose of an overhead application rate

Q62: Common stock is considered the legal capital

Q89: Current ratio and working capital<br>The balance

Q92: Based solely on the above information, Korman's

Q115: Gross pay less withholding tax and less

Q141: The current ratio at year-end (rounded to

Q150: Which of the following does not affect

Q219: The present value of an amount is:<br>A)