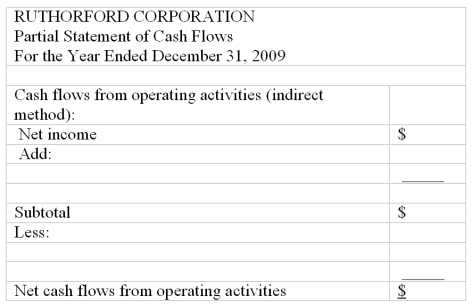

Cash flows from operating activities-indirect method

The data below are taken from the financial statements of the Rutherford Corporation:

Complete the partial statement of cash flows for the year ended December 31, 2009, showing the computation of net cash flows from operating activities by the indirect method:

Definitions:

Material Quantity Variance

The difference between the actual quantity of materials used in production and the standard quantity expected, multiplied by the standard cost per unit.

Labor Rate Variance

The difference between the actual cost of labor and the budgeted or standard cost, attributable to paying a higher or lower wage rate than anticipated.

Variable Overhead

Costs of production that fluctuate with the level of output, such as utilities or raw materials.

Direct Labor-hours

Represents the total hours worked directly on the production of goods, important for calculating the labor cost per unit.

Q16: If a bond is callable, the call

Q31: Which of the following would have no

Q35: Assume the exchange rate for the Mexican

Q42: A deficit appears in a corporation's financial

Q49: Assume all remaining treasury stock is reissued

Q77: The debt ratio indicates the percentage of:<br>A)

Q109: Which of the following is a period

Q114: Relationship of cash flows to accrual

Q150: The purchase of equipment for the manufacturing

Q167: Rag Dolls' cash flow from operating activities