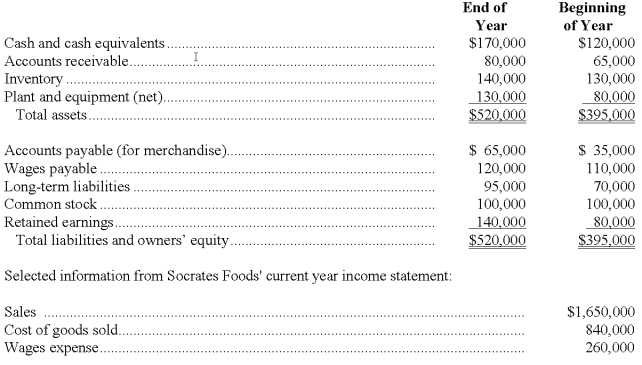

The following balance sheets are provided for Socrates Foods:

a. Compute the following:

(1) Cash received from customers during the year $__________

(2) Cash payments for merchandise during the year $__________

(3) Wages paid to employees during the year $__________

(4) In Socrates Foods' statement of cash flows, what amount would be reported as the net change in cash and cash equivalents? $__________ (increase/decrease)

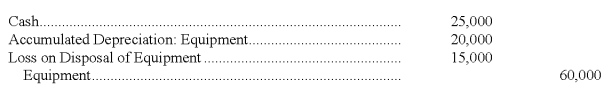

b. Socrates Foods recorded the sale of equipment as follows:

How would this transaction be reported in Socrates Foods' statement of cash flows? (Assume the direct method is being used.)

Definitions:

Tax Rate

The tax rate is the percentage at which an individual or corporation is taxed, determining how much tax needs to be paid on various income levels or economic activities.

Gain on Bargain Purchase

The financial gain recognized when a company acquires an asset for less than its fair value.

Non-Controlling Interest

This is an equity interest in a subsidiary not owned by the parent company, which has a claim on the subsidiary's earning and assets.

Business Combination

A transaction or event in which a company acquires control over one or more businesses, often through acquisition or merger.

Q7: Colfax Corporation's financial statements for the current

Q25: Eleva Corporation's accounts receivable turnover for 2011

Q42: During the current year, the Jules Company

Q43: Refer to the information above. If Amelia

Q58: The adjusting entry at December 31, 2009,

Q89: The "bottom line" in a statement of

Q123: Noble's gross profit rate was:<br>A) 18%.<br>B) 46%.<br>C)

Q127: When no-par stock is issued:<br>A) The entire

Q133: ROI: What and why?<br>In general terms, what

Q180: If accounts receivable decrease during the period,