Fully amortizing installment note payable

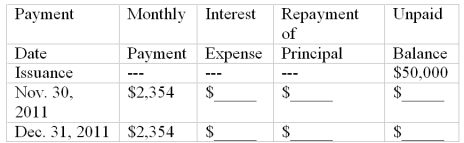

On October 31, 2011 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment. This note is payable in equal monthly installments of $2,354, which include interest computed at an annual rate of 12%. The first monthly payment is made on November 30, 2011. This note is fully amortizing over 24 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided. In addition, answer the questions that follow.

(a) With respect to this note, Ronald's 2011 income statement includes interest expense of $_______________, and Ronald's balance sheet at December 31, 2011, includes a total liability for this note payable of _______________. (Do not separate into current and long-term portions.)

(b) The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $_______________.

(c) Over the 2-year life of the note, the amount Ronald will pay for interest amounts to $_______________.

Definitions:

Production Function

A production function is a mathematical model that describes the relationship between inputs used in production (like labor and capital) and the output produced.

Profit

The financial gain achieved when the revenues obtained from business activities exceed the expenses, costs, and taxes associated with maintaining the activity.

Commodity

A primary item used in trading that is replaceable with other items of the same type.

Maximise

To increase to the greatest possible amount or degree.

Q46: In a periodic inventory system, the cost

Q49: Assume all remaining treasury stock is reissued

Q49: When a promissory note is issued, you

Q54: Which of the following practices best illustrates

Q73: In preparing a bank reconciliation, a service

Q98: When a company sells bonds, the bondholders

Q118: Paid-in-capital includes donated capital.

Q120: Refer to the information above. Assume that

Q136: At the beginning of the current year,

Q149: Beck Corporation declared a 2-for-1 common stock