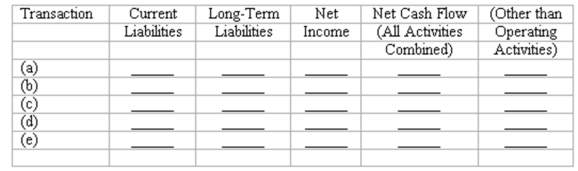

Effects of transactions upon financial measurements

Five events relating to liabilities are described below:

(a) Recorded a bi-weekly payroll, including the issuance of paychecks to employees. Amounts withheld from employees' pay and payroll taxes will be forwarded to appropriate agencies in the near future. (Ignore postretirement costs.)

(b) Made a monthly payment on a 12-month installment note payable, including interest and a partial repayment of the principal amount.

(c) Shortly before the maturity date of a six-month bank loan, made arrangements with the bank to refinance the loan on a long-term basis.

(d) Made an adjusting entry to record accrued interest payable on a 2-year bank loan (interest is paid monthly.)

(e) Made a year-end adjusting entry to amortize a portion of the discount on long-term bonds payable.

Indicate the immediate effects of each transaction or adjusting entry upon the financial measurements in the five column headings listed below. Use the code letters, I for increase, D for decrease, and NE for no effect.

Definitions:

Positive Autocorrelation

A situation in which the errors in a regression model are positively correlated, meaning that a positive error in one period is likely to be followed by a positive error in the next.

Multicollinearity

A situation in regression analysis where independent variables are highly correlated, making it difficult to estimate individual regression coefficients accurately.

Regression Coefficients

Regression coefficients are values that quantify the relationship between independent variables and a dependent variable in regression analysis.

Independent Variable

A variable that is manipulated or changed in an experiment to observe its effect on the dependent variable.

Q5: When a company uses straight-line depreciation and

Q13: Which of the following is not a

Q24: If Salem Co. retires $10 million of

Q29: A stock split will normally increase the

Q33: In its financial statements, Shoreham uses straight-line

Q42: Which of the following is (are) not

Q53: A corporation is a legal entity separate

Q134: Glouchester Associates sold office equipment for cash

Q148: Accelerated depreciation methods are used primarily in:<br>A)

Q195: The total liabilities related to this note