Fully amortizing installment note payable

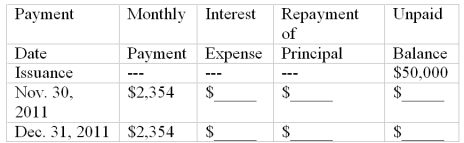

On October 31, 2011 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment. This note is payable in equal monthly installments of $2,354, which include interest computed at an annual rate of 12%. The first monthly payment is made on November 30, 2011. This note is fully amortizing over 24 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided. In addition, answer the questions that follow.

(a) With respect to this note, Ronald's 2011 income statement includes interest expense of $_______________, and Ronald's balance sheet at December 31, 2011, includes a total liability for this note payable of _______________. (Do not separate into current and long-term portions.)

(b) The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $_______________.

(c) Over the 2-year life of the note, the amount Ronald will pay for interest amounts to $_______________.

Definitions:

Contracture

Permanent shortening or contraction of a muscle.

Skeletal Muscle Tissue

A type of muscle tissue that is attached to bones and is responsible for voluntary movements of the body.

Smooth Muscle Tissue

A type of muscle tissue found in the walls of hollow organs like the intestines and blood vessels, which contracts involuntarily.

Motor Unit

A single motor neuron and all the muscle fibers it innervates, working together to perform muscular contraction.

Q29: Refer to the information above. Assume that

Q32: A 2-for-1 stock split will:<br>A) Increase the

Q56: Trego's entry at June 30, 2012, to

Q77: Refer to the information above. If Brookdale

Q79: At December 31, Year 1, the adjusting

Q81: When a company reports both diluted earnings

Q101: In order to receive a dividend, a

Q133: Some of the payroll-related expenses incurred by

Q141: Which of the following situations would not

Q178: The accounts receivable turnover rate for Baldwin