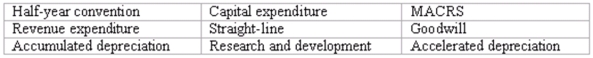

Accounting terminology. Listed below are nine technical accounting terms introduced in this chapter:

Each of the following statements may (or may not) describe one of these technical terms. In the space provided below each statement, indicate the accounting term described, or Answer "None" if the statement does not correctly describe any of the terms.

____ (a.) An expenditure to pay an expense of the current period.

____ (b.) The accelerated depreciation system used in federal income tax returns for depreciable assets purchased after 1986.

____ (c.) A policy that fractional-period depreciation on assets acquired or sold during the period should be computed to the nearest month.

____ (d.) An intangible asset representing the present value of future earnings in excess of normal return on net identifiable assets.

____ (e.) Expenditures that could lead to the introduction of new products, but which, according to the FASB, should be viewed as an expense of the current accounting period.

____ (f.) Depreciation methods that take less depreciation in the early years of an asset's useful life, and more depreciation in the later years.

____ (g.) An account showing the portion of the cost of a plant asset that has been written off to date as depreciation expense.

Definitions:

Disinhibit

To stimulate a response that has been suppressed (inhibited) by showing a model engaging in that response without aversive consequences.

Categorical Self

The stage of self-awareness in which infants and toddlers begin to understand and categorize themselves in terms of visible characteristics such as age and gender, usually developing around 18-24 months.

Preschool Period

The developmental period in early childhood that spans from ages 3 to 5, just before entering formal school.

Darkness

The absence of light in a particular area or environment, often associated with night or shadow.

Q25: When a corporation fails to pay a

Q38: Refer to the information above. Assume that

Q46: Trade-ins<br>Dietz owned a delivery van with a

Q54: Sanford Corporation borrowed $90,000 by issuing a

Q63: A capital expenditure is charged to owners'

Q72: Financial reporting of net losses and retained

Q77: Tutor uses the balance sheet approach in

Q157: Which of the following payroll costs are

Q172: If Salem Co. retires $10 million of

Q231: Accounts receivable appear in the balance sheet:<br>A)