Depreciation; gains and losses in financial statements

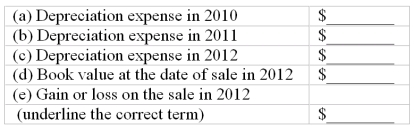

In 2010, Amalfi, Inc. purchased equipment with an estimated 10-year life for $42,600. The residual value was estimated at $9,900. Amalfi uses straight-line depreciation and applies the half-year convention.

On April 18, 2012, Amalfi closed one of its plants and sold this equipment for $33,600. Under these assumptions, compute the following for this equipment:

Definitions:

Geographic Area

A specific part of the Earth's surface defined by physical and geographical boundaries or coordinates.

Intermediate Courts of Appeal

Judicial bodies that exist between lower courts and the highest court in a jurisdiction, responsible for reviewing decisions and interpretations of law from trial courts.

Federal Circuit Courts of Appeal

The Federal Circuit Courts of Appeal are intermediate appellate courts in the United States responsible for reviewing decisions from federal district courts within their geographic circuit.

Limited Jurisdiction

A legal term referring to courts that are restricted in the types of legal matters they can decide, usually based on the subject matter, the amount in controversy, or the geographical area.

Q7: In a period of rising prices, a

Q40: The direct write-off method is more conservative

Q54: With respect to depreciation policies, the principle

Q54: Sanford Corporation borrowed $90,000 by issuing a

Q68: While preparing a bank reconciliation, an accountant

Q70: Financial assets describe not just cash, but

Q139: The financial statements of a corporation that

Q148: Which of the following is not an

Q163: Each of the following measures strengthens internal

Q220: An employer's total payroll-related costs always exceed