Depreciation; gains and losses in financial statements

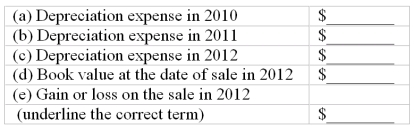

In 2010, Amalfi, Inc. purchased equipment with an estimated 10-year life for $42,600. The residual value was estimated at $9,900. Amalfi uses straight-line depreciation and applies the half-year convention.

On April 18, 2012, Amalfi closed one of its plants and sold this equipment for $33,600. Under these assumptions, compute the following for this equipment:

Definitions:

Intra-entity Purchases

Buying activities of goods or services conducted between departments or divisions within the same entity.

Equity Method

An accounting technique used to assess the profits earned by an investment in another company, recognizing such profits proportional to ownership share.

Intra-entity Purchases

Transactions involving the exchange of goods or services between entities within the same parent company, often leading to consolidation adjustments.

Gross Profit Rate

The ratio of gross profit to net sales, indicating the efficiency of a company in controlling its production or purchase costs.

Q35: On March 2, 2009, Glen Industries purchased

Q82: What is the "adjusted cash balance" at

Q87: Shore and Gardiner each own 10,000 shares

Q93: Special purpose entities (SPEs) are established by

Q104: The directors of a corporation:<br>A) Are hired

Q112: What is the maximum amount Gamma can

Q123: If a bond is issued at par

Q142: If the income statement method of estimating

Q148: Busch, Inc. is a successful company, but

Q188: The amount of cash that should appear