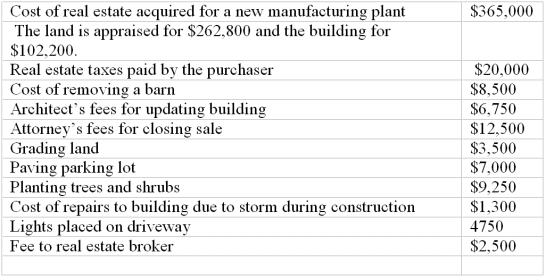

The following expenditures are related to land, land improvements, and buildings, which were acquired on November 1, 2009.

Required:

Determine the cost of the land, the building and the improvements (Round to the nearest dollar)

Prepare journal entries on December 31, 2009 for depreciation assuming the building will have a useful life of 20 years and no residual value. Use double declining balance method and the half-year convention. Depreciate the land improvements using straight-line method, a 5 year life, to the nearest month with zero residual value (to the nearest dollar).

Definitions:

Skill-based Pay Plans

Compensation systems that pay employees based on the range, depth, or complexity of their skills and knowledge, rather than their job title or position.

Job Evaluation

The process of analyzing and assessing various jobs systematically to ascertain their relative worth within an organization.

Job Status-based Rewards

Compensation or benefits given to employees based on their position or rank within an organization.

Bureaucratic Hierarchy

An organizational structure with clear levels of authority and a fixed set of rules and procedures to control operations and decision-making.

Q24: Assuming that Ace Systems uses the LIFO

Q42: What is the total liability related to

Q67: Stock values<br>Presented below is an excerpt from

Q110: Revenue expenditures are recorded as:<br>A) An expense.<br>B)

Q125: The lower of cost or market rule

Q144: In the fixed-percentage-of-declining-balance depreciation method, the book

Q171: What is the amount of the interest

Q184: Marketable securities<br>(a.) Explain how investments in available-for-sale

Q186: Unearned revenue:<br>A) Appears on the income statement

Q209: If a long-term debt is to be