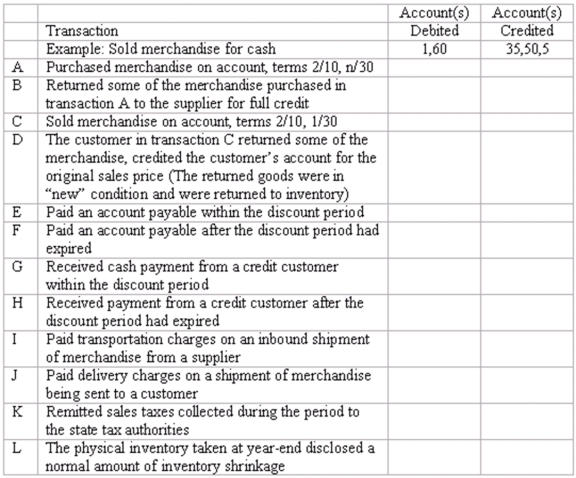

Journal entries for merchandising transactions Shown below is a partial chart of accounts for Main Street Markets, followed by a series of merchandising transactions. The company uses a perpetual inventory system, records purchases at net cost, and records sales at the full invoice price. Sales taxes are collected on all sales, and the sales tax liability is recorded immediately. Freight charges on inbound shipments are recorded in the Transportation-in account.

Indicate the accounts that should be credited in recording each transaction by placing the appropriate account number(s) in the space provided.

Definitions:

Trial Court

The level of court in which a case is first heard and evidence is presented, serving as the initial forum for legal disputes.

Civil Procedure

The body of law governing the process and procedures by which civil matters are adjudicated in the court system.

Procedural Due Process

A principle required by the Constitution that when the state or federal government acts in such a way that denies a citizen of a life, liberty, or property interest, the person must first be given notice and the opportunity to be heard.

Daimler AG

A multinational automotive corporation headquartered in Stuttgart, Germany, known for manufacturing premium vehicles under the Mercedes-Benz brand.

Q19: Shop supplies are expensed when:<br>A) Consumed.<br>B) Purchased.<br>C)

Q54: The manager of National Software wants to

Q55: Refer to the information above. The entry

Q83: The total amount debited to the Inventory

Q100: A store that sells expensive custom-made jewelry

Q122: Articulation between the financial statements means that

Q126: Publicly traded companies must file audited financial

Q127: The agreement of the debit and credit

Q144: The balance in the Cash account at

Q195: Hubbard Transport keeps $500 cash on hand