Accounting terminology

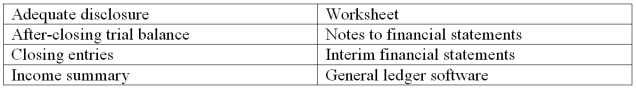

Listed below are eight technical accounting terms emphasized in this chapter:

In the space provided for each statement, indicate the accounting term described.

____ a. The generally accepted accounting principle of providing with financial statements any information that users need to interpret those statements properly.

____ b. A trial balance prepared after all closing entries have been posted. This trial balance consists only of accounts for assets, liabilities, and owners' equity.

____ c. Journal entries made at the end of the period for the purpose of closing temporary accounts (revenue, expense, and dividend accounts) and transferring balances to the Retained Earnings account.

____ d. Computer software used for recording transactions, maintaining journals and ledgers, and preparing financial statements. Also includes spreadsheet capabilities for showing the effects of proposed adjusting entries or transactions on the financial statements without actually recording these entries in the accounting records.

____ e. The summary account in the ledger to which revenue and expense accounts are closed at the end of the period. The balance (credit balance for a net income, debit balance for a net loss) is transferred to the Retained Earnings account.

____ f. Financial statements prepared for periods of less than one year (includes monthly and quarterly statements).

____ g Supplemental disclosures that accompany financial statements. These notes provide users with various types of information considered necessary for the proper interpretation of the statements.

____ h. A multicolumn schedule showing the relationships among the current account balances (a trial balance), proposed or actual adjusting entries or transactions, and the financial statements that would result if these adjusting entries or transactions were recorded. Used both at the end of the accounting period as an aid to preparing financial statements and for planning purposes.

Definitions:

Net Income

The concluding profit margin of a company after deducting all operational expenditures and taxes from its income.

Revenues

Income that a company receives from its normal business activities, usually from the sale of goods and services to customers.

Beginning Inventory

The amount of goods presented for buying at the initial stage of an accounting term.

Goods Available for Sale

The total quantity of goods that a company has in stock and is available to be sold, including both finished goods and those still in production.

Q26: This transaction involves:<br>A) Galloway's collection of $20,000

Q42: An adjusting entry to recognize that a

Q67: Which of the following should not be

Q108: If total assets of Hercules Manufacturing, Inc.

Q110: Adequate disclosure<br>(A.) Briefly explain what is meant

Q127: The agreement of the debit and credit

Q141: On January 6, the cash balance is:<br>A)

Q147: At the beginning of the year, Robert

Q156: Valuation of assets under generally accepted accounting

Q233: Tutor uses the income statement approach in