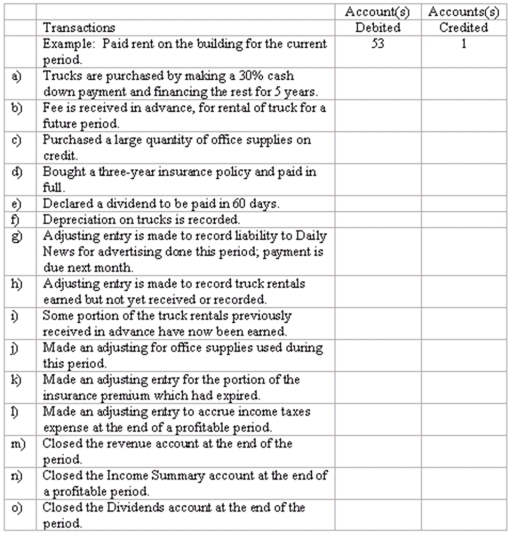

Adjustments and closing process-basic entries

Selected ledger accounts used by Speedy Truck Rentals, Inc., are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

Airline Companies

Businesses that provide air transport services for traveling passengers and freight.

Tickets

Documents or electronic codes that grant the holder a right to enter a venue, travel on a vehicle, or participate in an event.

Tying Arrangement

A business practice where a seller requires the purchase of a secondary product or service in addition to a primary product or service.

Vacuum Cleaners

Electrical appliances used for cleaning floors and other surfaces by suctioning up dust and dirt.

Q4: In the notes to financial statements, adequate

Q18: What is the total owners' equity at

Q46: A trial balance that is out of

Q57: Which of the following amounts appears in

Q68: The December 31, 2010 worksheet for Fran's

Q68: The purchase of equipment on credit is

Q94: Indicate all correct answers. Dividends:<br>A) Decrease owners'

Q99: If total assets equal $345,000 and total

Q101: Entries made in the general journal after

Q135: The current ratio is a measure of