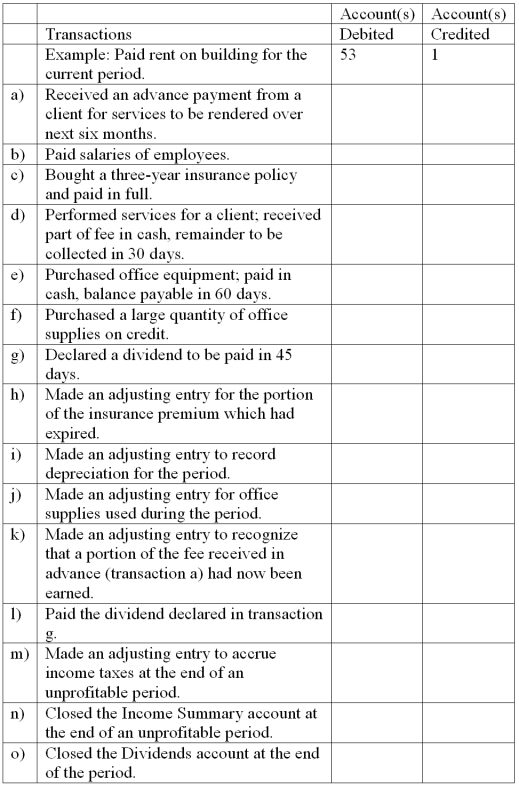

Adjustments and closing process--basic entries

Selected ledger accounts used by Goldstone Advertising, Inc., are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

Neurotransmitter Activity

The action or process by which neurotransmitters are released, bind to receptors, and elicit a response in the nervous system, influencing behavior and mood.

Antigens

Foreign substances that enter the body and trigger an immune response, often leading to the production of antibodies.

T-Cells

A type of white blood cell that plays a central role in the immune system by identifying and attacking foreign pathogens.

Lymphocytes

A type of white blood cell that plays a significant role in the immune system, defending the body against infection.

Q2: J. Lennon borrows a sum of money

Q20: The basic purpose of offering customers cash

Q63: The manager of Grande Home Improvements purchased

Q72: Assuming a 365 day year, Bush Industries

Q110: "I was just following orders" is an

Q128: According to the rules of debit and

Q133: On January 6, total assets of the

Q133: Which of the following is provided by

Q153: Internal control is strengthened by a policy

Q201: Short-term investments in marketable securities may not