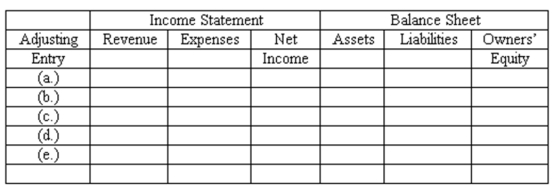

Adjusting entries-effect on elements of financial statements

Galaxy Entertainment prepares monthly financial statements. On July 31, the accountant made adjusting entries to record:

(A.) Depreciation for the month of July.

(B.) The portion of prepaid rent for outdoor stage and seating which had expired in July.

(C.) Earning of ticket revenue for July which had been subscribed in advance. (When patrons purchase the Summer Jazz Series tickets in advance, the accountant credits Unearned Ticket Revenue.)

(D.) Amount owed to Universal from the caterer who sold food and beverages during the July performances. The amount due will be paid to the company on August 8.

(E.) Amount owed to the musicians which had accrued since the last pay day in July.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is, on revenue, expenses, net income, assets, liabilities, and owners' equity. Organize your answer in tabular form, using the column headings shown below and the symbols + for increase, - for decrease, and NE for no effect.

Definitions:

Nuclear Reactor

A device used to initiate and control a sustained nuclear chain reaction, primarily for the generation of electricity.

Net Useful Energy

The amount of energy available for use after subtracting the energy lost in conversion, transmission, and distribution processes.

Fissionable Fraction

The portion of a nuclear fuel that can undergo fission, the process by which atomic nuclei split to release energy.

Uranium-235

A naturally occurring isotope of uranium with the ability to undergo fission, making it a critical component for nuclear reactors and weapons.

Q3: Capital Financial Advisors, Inc. had the following

Q23: Net Sales is computed as total sales

Q79: What is the total owners' equity at

Q107: Refer to the information above. The entry

Q113: Every transaction affects equal numbers of ledger

Q122: Articulation between the financial statements means that

Q131: A statement of cash flows depicts the

Q140: On June 4, the balance in the

Q158: Assuming Dynamic, Inc. uses the income statement

Q169: At December 31, 2009, Laconia Industries' portfolio