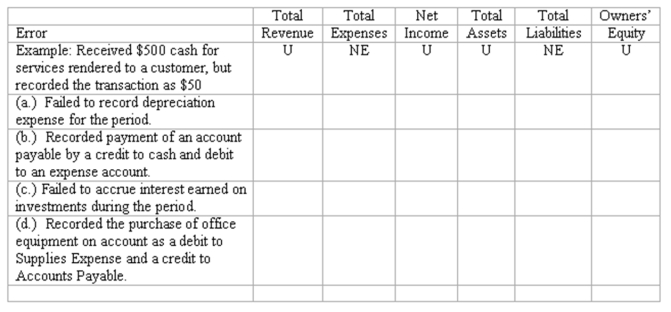

Effects of errors on financial statements

Indicate the immediate effect of the following errors on each of the accounting elements described in the column headings below, using the following code: O = Overstated; U = Understated; NE = No Effect.

Definitions:

Unearned Revenue

Money received by a company for goods or services yet to be delivered or provided, considered a liability until the goods or services are delivered.

Double Rule

A method used in accounting to draw attention to totals or end of reports by placing two lines beneath them for emphasis.

Total

The aggregate amount or sum of individual items or elements in a set or group.

Closing Journal Entries

The entries made at the end of an accounting period to transfer the balances in temporary accounts to permanent accounts and prepare the company's books for the next period.

Q10: At the end of the current year,

Q29: A partnership has a limited life and

Q39: Which of the following credit terms is

Q51: The current ratio equals current assets plus

Q65: The concept of materiality:<br>A) Involves only tangible

Q88: Which of the following is not a

Q109: Instead of paying for merchandise purchased on

Q110: The December 31, 2011 worksheet for Albertville

Q113: Measures of profitability tell us how quickly

Q117: In a perpetual inventory system:<br>A) Merchandising transactions