End-of-period adjustments - selected computations

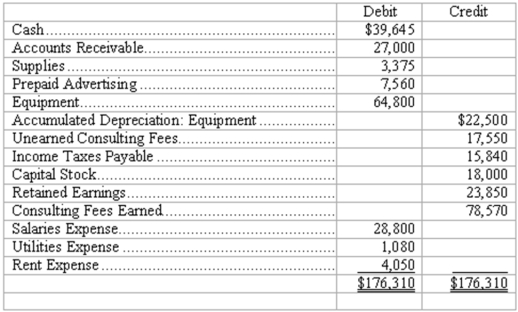

Allied Architects adjusts its books each month and closes its books at the end of the year. The trial balance at January 31, 2010, before adjustments is as follows:

The following information relates to month-end adjustments:

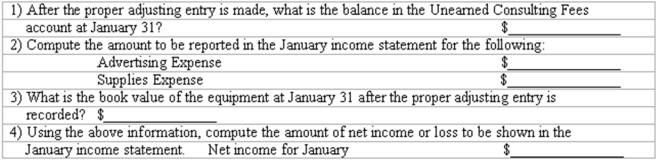

(a) According to contracts, consulting fees received in advance that were earned in January total $13,500.

(b) On November 1, 2009, the company paid in advance for 5 months' advertising in professional journals.

(c) At January 31, supplies on hand amount to $2,250.

(d) The equipment has an original estimated useful life of 4 years.

(e) The corporation is subject to income taxes of 25% of taxable income. (Assume taxable income is the same as "income before taxes.")

Definitions:

Commercial Banks

Financial institutions that offer a wide range of services, including accepting deposits, providing loans, and other investment products to individuals and businesses.

Open Market

A freely competitive market in which any buyer or seller can participate, characterized by the absence of monopolies or exclusive control.

Government Bonds

Debt securities issued by a government to finance its expenditures, often backed by the government's ability to tax its citizens.

Money Supply

The total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances in bank accounts.

Q10: Every stockholder in a corporation will have

Q20: Which of the following is not a

Q48: Interim financial statements usually report on a

Q52: The United Shipping Co. made an adjusting

Q52: During the closing process:<br>A) All income statement

Q54: Investors and creditors are interested in a

Q87: Which of the following decision makers is

Q100: What should be the December 31 balance

Q122: The IRS tax return is one of

Q149: Unpaid expenses may be included as an