End-of-period adjustments

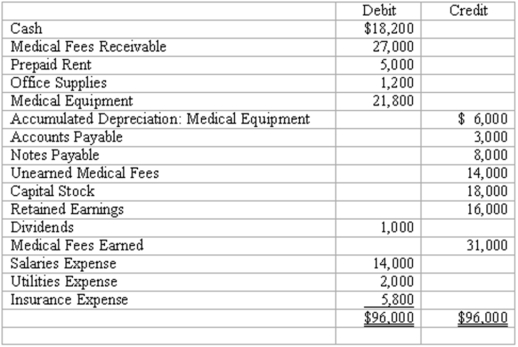

West Laboratory adjusts and closes its accounts at the end of each month. The trial balance at September 30, 2010, before adjustments, is as follows:

The following information relates to month end adjustments:

(a) Office supplies on hand September 30 amounted to $500.

(b) The useful life of the medical equipment was estimated to be 20 years with no residual

value.

(c) Many patients pay in advance for major medical procedures. Fees of $6,000 were earned during the month by performing procedures on patients who had paid in advance.

(d) Salaries earned by employees during the month but not yet recorded amounted to $2,300.

(e) On September 1, West Laboratory had moved and paid 2 month's rent in advance.

(f) Medical procedures performed during the month but not yet billed or recorded amounted to $4,600.

Prepare the adjusting entries required at September 30.

Definitions:

Wage Base Limits

The maximum amount of income that is subject to social security or other payroll taxes within a tax year.

Payroll Tax Expense

The employer’s expense associated with the employment taxes (Social Security, Medicare, and unemployment taxes) on the wages paid to employees.

Federal Unemployment Taxes

Taxes paid by employers based on employee wages/salaries to fund unemployment compensation to workers who have lost their jobs.

Medical Insurance

Health care insurance for which premiums may be paid through a deduction from an employee’s paycheck.

Q24: Which of the following appears in the

Q30: If a 15%, 60-day note receivable is

Q59: The realization principle indicates that revenue usually

Q63: Which of the following is not considered

Q77: In the general ledger, a separate "account"

Q78: Windsor uses the balance sheet approach in

Q100: In a periodic inventory system, which of

Q107: After preparing the financial statements for the

Q111: Which of the following accounts normally has

Q197: Reporting cash in the balance sheet<br>(a.) The