Adjusting entries

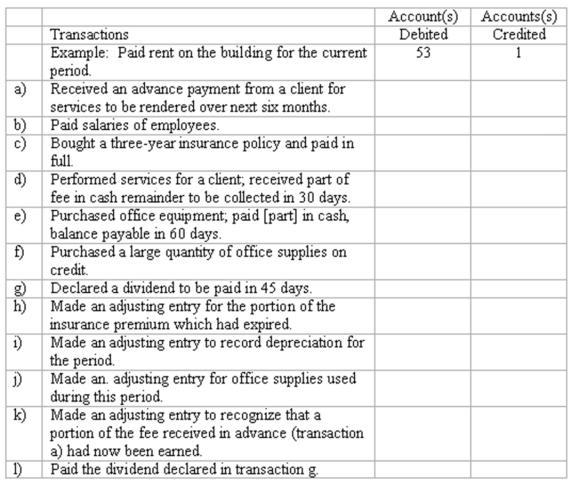

Selected ledger accounts used by American Advertising, Inc., are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

Required Production

The quantity of goods that must be produced during a particular time period to meet customer demand.

Direct Labor Cost

The expenses associated with paying the wages of workers directly involved in manufacturing goods or providing services.

Budgeted Sales

The projected amount of sales, in units or dollars, that a company expects to achieve during a specific period.

Credit Sales

Sales in which the customer is allowed to pay for the goods or services at a later date, rather than at the time of purchase.

Q7: Effects of a series of transactions on

Q11: Which of the following accounting principles is

Q79: The purpose of making closing entries is

Q87: Watins, Inc.'s 2011 income statement reported net

Q98: If Cash at December 31, 2009, is

Q100: Which of the following accounts would never

Q117: Only two adjustments appear in the adjustments

Q118: Under accrual accounting, fees received in advance

Q147: At the beginning of the year, Robert

Q229: Write-off of uncollectible account receivable<br>On January 10,