End-of-period adjustments-effect on net income

Ocean View, Inc. reported revenues of $645,000 and expenses of $360,000 for the month of May, before making any month-end adjusting entries. The following data are provided regarding adjusting entries:

(A.) Portion of insurance expiring in May, $2,520.

(B.) A customer has used the facilities for two weeks in May; the fee of $4,200 has not yet been billed.

(C.) Amount owed for salaries accrued in the last week of May, $1,650.

(D.) Depreciation on equipment for May $1,290.

(E.) Supplies used in May, $13,125.

(F.) Fees collected in advance which have been earned during May, $23,400.

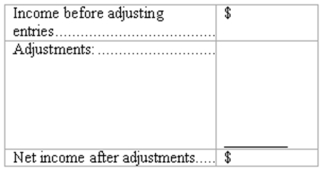

Complete the schedule to determine the net income of Ocean View Inc. for May after these adjustments have been recorded. Begin your schedule with income before adjusting entries and then show the effect of each adjustment to arrive at net income after adjustment.

Definitions:

Creative Customer Service

Innovative approaches to providing support and care to customers, aiming to exceed expectations and solve problems uniquely.

Gain-Sharing Plans

A performance-based compensation strategy that shares the cost savings from productivity improvements with employees.

Repeat Business

The recurrence of customer purchases due to satisfaction with a product or service, contributing to the company's revenue over time.

Attendance Plans

Policies or programs established by an organization to manage employee attendance, including tracking, incentives for good attendance, and consequences for excessive absenteeism.

Q8: What is the balance in the Note

Q9: Financial statements must be prepared for which

Q25: Which of the following statements about a

Q47: Inventory is a relatively liquid asset and

Q50: In a ledger, debit entries cause:<br>A) Increases

Q59: Interim financial statements:<br>A) Cover a period less

Q77: Which account listed below is classified as

Q77: Tutor uses the balance sheet approach in

Q86: If current assets are $90,000 and current

Q113: All of the following accounts normally have