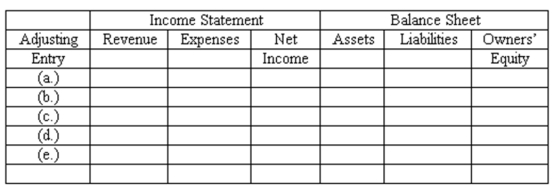

Adjusting entries-effect on elements of financial statements

Galaxy Entertainment prepares monthly financial statements. On July 31, the accountant made adjusting entries to record:

(A.) Depreciation for the month of July.

(B.) The portion of prepaid rent for outdoor stage and seating which had expired in July.

(C.) Earning of ticket revenue for July which had been subscribed in advance. (When patrons purchase the Summer Jazz Series tickets in advance, the accountant credits Unearned Ticket Revenue.)

(D.) Amount owed to Universal from the caterer who sold food and beverages during the July performances. The amount due will be paid to the company on August 8.

(E.) Amount owed to the musicians which had accrued since the last pay day in July.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is, on revenue, expenses, net income, assets, liabilities, and owners' equity. Organize your answer in tabular form, using the column headings shown below and the symbols + for increase, - for decrease, and NE for no effect.

Definitions:

Comparative Consolidated Financial Statements

Financial statements that provide financial information for multiple periods, offering a way to compare a company's financial performance over time.

Acquisition Differential

The difference between the cost of acquiring a company and the fair value of its identifiable net assets, often recognized as goodwill.

Business Combination

A transaction or event in which an acquirer gains control over one or more businesses, merging entities into one operational unit.

Voting Shares

Voting shares are shares of a company's stock that grant the shareholder the right to vote on corporate policy and the composition of the board of directors.

Q3: Capital Financial Advisors, Inc. had the following

Q4: Bernice Beverages is not satisfied with the

Q24: Which of the following appears in the

Q38: If current assets are $180,000 and current

Q64: Management accounting information is oriented toward the

Q102: What is the balance in Retained Earnings

Q116: Pet Foods Plus purchased bagged dog food

Q127: The concept of adequate disclosure:<br>A) Does not

Q138: Every transaction which affects an income statement

Q159: The book value of a depreciable asset