End-of-period adjustments - selected computations

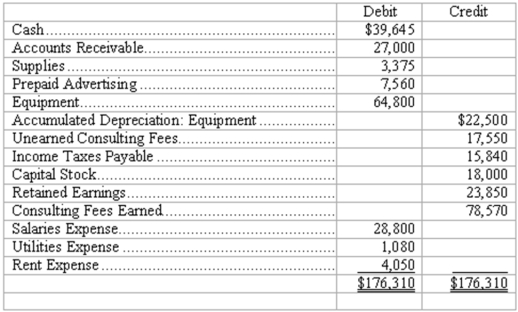

Allied Architects adjusts its books each month and closes its books at the end of the year. The trial balance at January 31, 2010, before adjustments is as follows:

The following information relates to month-end adjustments:

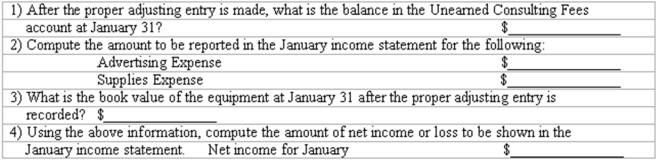

(a) According to contracts, consulting fees received in advance that were earned in January total $13,500.

(b) On November 1, 2009, the company paid in advance for 5 months' advertising in professional journals.

(c) At January 31, supplies on hand amount to $2,250.

(d) The equipment has an original estimated useful life of 4 years.

(e) The corporation is subject to income taxes of 25% of taxable income. (Assume taxable income is the same as "income before taxes.")

Definitions:

Practices

Practices encompass the habitual actions, methods, or procedures employed in particular fields or activities, aimed at achieving proficiency, efficiency, or standardization.

Top-level Leaders

Individuals occupying the highest positions in an organization, responsible for strategic planning, decision-making, and guiding the organization towards its goals.

Entire Organization

Refers to all aspects and components of a business or institution, encompassing its structure, culture, employees, and operations.

Implicit Leadership Theories

Personal assumptions about the traits and abilities that characterize an ideal organizational leader.

Q2: Closely held corporations have the same ability

Q4: Which of the following is generally not

Q10: Sunset Tours has a $3,500 account receivable

Q60: If during the current year, liabilities of

Q79: The purpose of making closing entries is

Q83: Briefly explain how generally accepted accounting principles

Q84: Which of the following explains the debit

Q88: This transaction involves:<br>A) Martin's collection of $35,000

Q126: Under the perpetual inventory system, two entries

Q156: Valuation of assets under generally accepted accounting