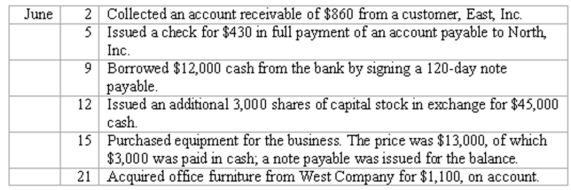

Recording transactions in general journal

Enter the following transactions in the two-column journal of Festive Parties, Inc. Include a brief explanation of the transaction as part of each journal entry.

Definitions:

Base Amount

A specific income threshold set by tax regulations, which may affect the calculation of deductions, credits, or taxes owed.

Credit Calculation

The process of determining the amount of credit that taxpayers are eligible to subtract directly from the taxes they owe to the government.

Nontaxable Social Security

Portions of Social Security benefits that are not subject to federal income tax under certain conditions.

AGI

Adjusted Gross Income; a measure of income calculated from your gross income and used to determine how much of your income is taxable.

Q2: Financial instruments do not include:<br>A) Contracts that

Q3: Which of the following businesses is most

Q19: Compound interest:<br>A) Is interest only on the

Q58: The normal balance of the Accumulated Depreciation

Q71: Financial statements<br>Briefly describe the balance sheet, the

Q112: Which of the following is not an

Q115: Which statement is true about land?<br>A) Land

Q128: The two basic approaches to accounting for

Q128: Omission of the adjusting entry needed to

Q135: The current ratio is a measure of