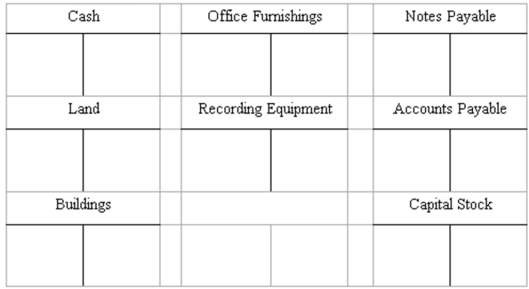

Recording transactions in T accounts; trial balance

On May 15, George Manny began a new business, called Sounds, Inc., a recording studio to be rented out to artists on an hourly or daily basis. The following six transactions were completed by the business during May:

(A.) Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(B.) Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000.

(C.) Installed special insulation and soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. Manny considers these items to be additional costs of the building.

(D.) Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Sounds paid $28,000 cash with the balance due in 30 days.

(E.) Borrowed $180,000 from a bank by signing a note payable.

(F.) Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at May 31 by completing the form provided.

SOUNDS, INC.

Trial Balance

May 31, 20__

Debit Credit

Definitions:

Concentric Contraction

Muscle contraction where muscle fibers shorten while generating force, typically occurring when a muscle is actively producing movement.

Muscle Tension

Describes the state of partial contraction in a muscle, even when it is not actively being used, helping to maintain posture and readiness for action.

Contraction

The process of muscle fibers shortening in response to stimulation, resulting in movement or tension in the muscle.

Rigor Mortis

Increased rigidity of muscle after death due to cross-bridge formation between actin and myosin as calcium ions leak from the sarcoplasmic reticulum.

Q9: Any business event that might affect the

Q33: Prior to taking a physical inventory at

Q41: Refer to the information above. Net income

Q56: Return on investment is the same as

Q77: Refer to the information above. Income Summary

Q89: During her youth, Shara's behavior could best

Q103: Generally accepted accounting principles were established by

Q109: Which of the following is generally not

Q129: Recognizing revenue when it is earned and

Q132: In the phrase "generally accepted accounting principles,"