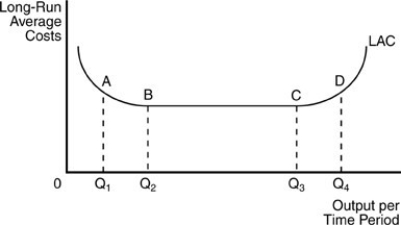

-In the above figure, point B is called

Definitions:

Exercise Price

The price at which the holder of an option can buy (in case of a call option) or sell (in case of a put option) the underlying security or commodity.

Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy an asset at a specified price within a certain time frame.

Exercise Price

The specified price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Risk-Free Rate

The return on investment of a risk-free asset, typically considered as government bonds, where the investor is assumed to have zero default risk.

Q1: The ABC Corporation earned a real rate

Q6: Suppose the auto industry has several investment

Q30: As a firm continues to produce additional

Q201: Suppose that Justin Timberlake sells 10,000 tickets

Q202: Suppose the supply of land is perfectly

Q240: "Stocks and bonds" are collectively known as<br>A)securities.<br>B)equities.<br>C)real

Q334: Assume that in the short run a

Q395: Which of the following is considered an

Q425: The theory that there is no way

Q428: The more profits are reinvested into the